2025 Married Tax Brackets. Heads of household can claim $1,100 more in 2025, with a standard. Income from $ 0.01 :

For single and married people filing individually, their standard deduction increases by $750 to $14,600. See the tax rates for the 2025 tax year.

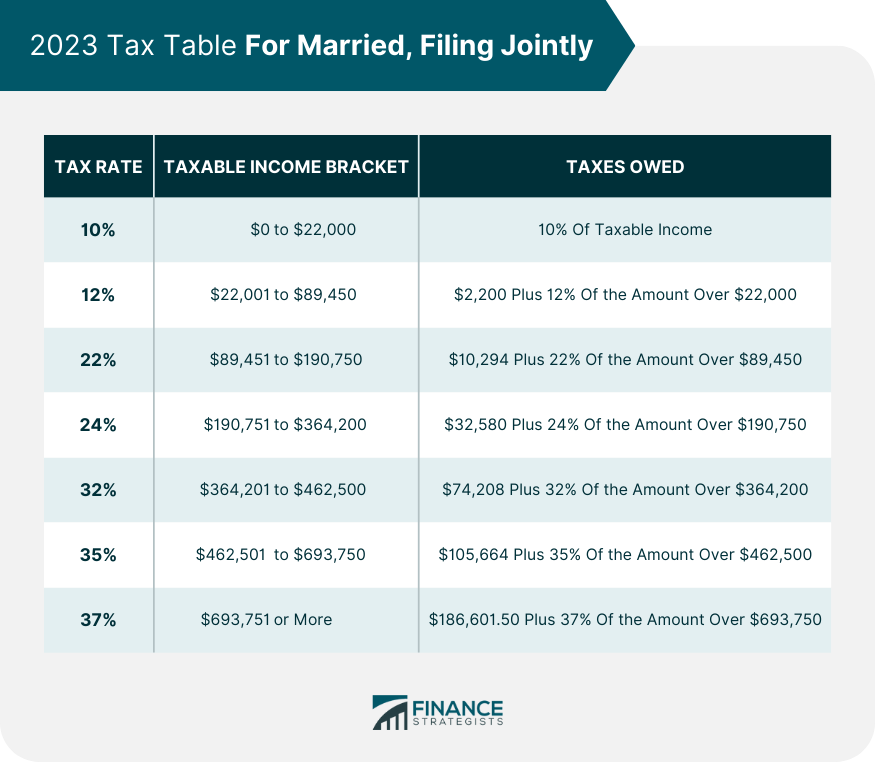

Tax Changes for 2025 What You Need to Know Guiding Wealth, Federal tax brackets for 2025 and 2025 r/thecollegeinvestor, 10%, 12%, 22%, 24%, 32%, 35% and 37%. Page last reviewed or updated:

Married tax brackets 2025 westassets, Income in america is taxed by the federal. There are seven tax brackets for most ordinary income for the 2025 tax year:

Tax filers can keep more money in 2025 as IRS shifts brackets The Hill, 10%, 12%, 22%, 24%, 32%, 35%, and 37%. 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent and 37 percent.

Federal Tax Earnings Brackets For 2025 And 2025 bestfinanceeye, The seven federal tax bracket rates range from 10% to 37% 2025 tax brackets and federal income tax rates. How do tax brackets work?

Capital Gains Tax Brackets For 2025 And 2025, (you can find the 2025 tax rates and brackets here.). Below, cnbc select breaks down the updated tax brackets for 2025 and what you need to know about them.

2025 IRS Inflation Adjustments Tax Brackets, Standard Deduction, EITC, The irs has adjusted federal income tax bracket ranges for the 2025 tax year to account for inflation. Income in america is taxed by the federal.

2025 Us Tax Brackets Irs Rezfoods Resep Masakan Indonesia, The irs has adjusted federal income tax bracket ranges for the 2025 tax year to account for inflation. The 2025 tax year, and the return due in 2025, will continue with these.

Tax Brackets Definition, Types, How They Work, 2025 Rates, For married couples who file a joint tax return, the 2025 income brackets and corresponding tax rates are as follows: Income tax brackets for 2025 are set.

Tax Season Guide Married Filing Jointly vs. Separately Chime, What we'll cover 2025 tax brackets (for taxes filed in 2025) Taxable income is generally adjusted gross income (agi) less the standard or itemized deductions.

Tax brackets 2019 vptiklo, The seven federal tax bracket rates range from 10% to 37% 2025 tax brackets and federal income tax rates. 10%, 12%, 22%, 24%, 32%, 35%, and 37%.